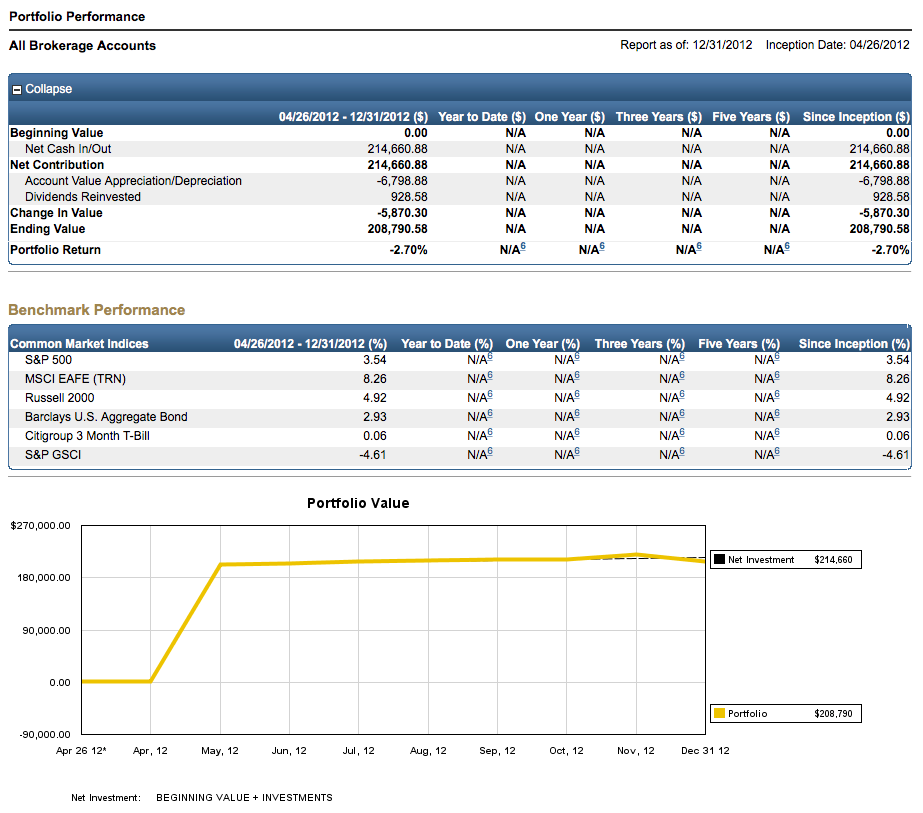

My core investing approach is to only buy stocks that are on the Dividends Aristocrats list. I learned this approach in 2005 when I read the Future For Investors by Jeremy Siegel.

I have not been able to find a stock screening tool that focuses solely on the Dividend Aristocrats, so I built my own and it is below.

Since I will be updating the tool whenever I am doing my own stock analysis, I also placed it in the Tools section of the website.

The table does not display fully in today’s post due to the sidebar. The horizontal scroll bar is at the bottom. I made the Crush The Market Tool a single page in the Tools section. You can see the fill-width table here.

Buy these stocks and you will crush the market.

What the tool does:

– Data goes back to 1/2/1970 if stock was trading

– Data goes back to the first date available if not 1/2/1970

– Accounts for splits and dividends

– Displays the CAGR (Cumulative Annual Growth Rate) for each stock

– Displays the current Dividend Yield %

– Displays the current Annual Dividend in $’s

– Displays the Ex-Dividend Date

– Displays Number of years of stock history

– Can search the entire table

– Can sort any of the columns (Ascending & Descending)

– S&P 500 CAGR is listed at the bottom of the table. I listed the S&P 500 at the bottom of the table since it performs worse than the majority of the Dividend Aristocrats.

How to Use:

– Find the best performing stock? Sort Descending by “CAGR” column.

– Find the highest dividend yield? Sort Descending by “Dividend Yield %” column.

– Find the highest dividend amount ($)? Sort Descending by “Annual Dividend $” column.

– Find when a you need to buy a stock to get the next quarterly dividend payment? Sort Ascending by “Ex-Date” column and add 3 months. Look the stock up on your favorite stock website to find the exact Ex-Dividend Date.

– Find out if you just missed buying a stock to get the next quarterly dividend payment? Sort Descending by “Ex-Date” column and add 3 months. Look the stock up on your favorite stock website to find the exact Ex-Dividend Date.

| Company Name | Ticker | Number of Years | CAGR | Dividend Yield % | Annual Dividend $ | Ex-Date |

|---|---|---|---|---|---|---|

| AbbVie | ABBV | 4.00 | 19.00 | 4.19 | 2.56 | 2017-01-11 |

| Abbott Laboratories | ABT | 34.02 | 13.20 | 2.62 | 1.06 | 2017-01-11 |

| Archer-Daniels-Midland Co | ADM | 34.02 | 9.90 | 2.68 | 1.20 | 2016-11-14 |

| Air Products & Chemicals Inc. | APD | 34.02 | 13.10 | 2.21 | 2.28 | 2016-12-07 |

| AFLAC Inc. | AFL | 33.02 | 17.00 | 2.45 | 1.72 | 2016-11-14 |

| Automatic Data Processing | ADP | 34.02 | 12.30 | 2.35 | 3.44 | 2016-12-29 |

| C. R. Bard | BCR | 34.02 | 12.60 | 0.449 | 1.04 | 2017-01-19 |

| Becton Dickinson | BDX | 34.02 | 13.80 | 1.69 | 2.92 | 2016-12-07 |

| Franklin Resources | BEN | 35.02 | 23.10 | 2.0 | 0.80 | 2016-12-28 |

| Bemis Company | BMS | 33.02 | 12.60 | 2.33 | 1.16 | 2016-11-14 |

| Cardinal Health Inc. | CAH | 30.02 | 17.00 | 2.40 | 1.80 | 2016-12-29 |

| Cincinnati Financial Corp | CINF | 29.02 | 10.90 | 5.46 | 3.84 | 2016-12-19 |

| Colgate-Palmolive | CL | 40.03 | 11.40 | 2.30 | 1.56 | 2017-01-19 |

| The Clorox Company | CLX | 34.02 | 14.10 | 2.64 | 3.20 | 2016-10-24 |

| Cintas Corp | CTAS | 28.02 | 12.80 | 4.67 | 5.32 | 2016-11-02 |

| Chevron Corp. | CVX | 46.03 | 7.30 | 3.74 | 4.32 | 2016-11-16 |

| Dover Corp | DOV | 32.02 | 10.40 | 2.23 | 1.76 | 2016-11-28 |

| Ecolab Inc | ECL | 29.02 | 14.20 | 1.25 | 1.48 | 2016-12-16 |

| Consolidated Edison Inc | ED | 46.03 | 10.10 | 3.67 | 2.68 | 2016-11-14 |

| Emerson Electric | EMR | 45.03 | 9.60 | 3.26 | 1.92 | 2016-11-08 |

| Genuine Parts Company | GPC | 34.02 | 10.80 | 2.64 | 2.63 | 2016-12-07 |

| W. W. Grainger | GWW | 33.02 | 13.20 | 1.98 | 4.88 | 2016-11-09 |

| HCP | HCP | 33.02 | 11.60 | 4.92 | 1.48 | 2016-11-08 |

| Hormel Foods Corp | HRL | 27.02 | 13.20 | 1.9 | 0.68 | 2017-01-12 |

| Illinois Tool Works | ITW | 33.02 | 12.70 | 2.10 | 2.60 | 2016-12-28 |

| Johnson & Johnson | JNJ | 46.03 | 12.80 | 2.80 | 3.20 | 2016-11-18 |

| Kimberly-Clark | KMB | 33.02 | 12.90 | 3.17 | 3.68 | 2016-12-07 |

| Coca-Cola Co | KO | 46.03 | 11.90 | 3.39 | 1.40 | 2016-11-29 |

| Leggett & Platt | LEG | 30.02 | 12.70 | 2.85 | 1.36 | 2016-12-13 |

| Lowe's Companies, Inc. | LOW | 32.02 | 16.30 | 1.95 | 1.40 | 2016-10-17 |

| McDonald's | MCD | 46.03 | 14.80 | 3.08 | 3.76 | 2016-11-29 |

| Medtronic | MDT | 36.02 | 15.40 | 2.29 | 1.72 | 2016-12-21 |

| McCormick & Company | MKC | 40.03 | 8.70 | 2.01 | 1.88 | 2016-12-28 |

| 3M Company | MMM | 46.03 | 10.70 | 2.49 | 4.44 | 2016-11-16 |

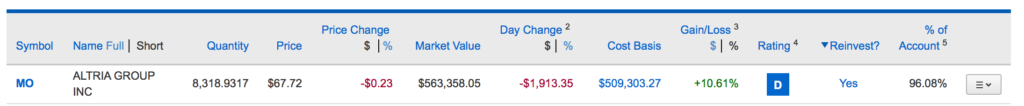

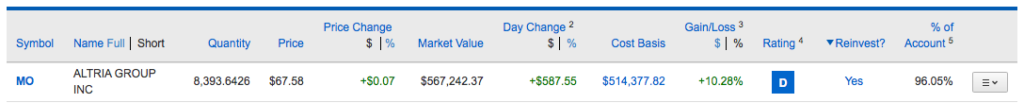

| Altria Group | MO | 46.03 | 20.60 | 3.49 | 2.44 | 2016-12-20 |

| Nucor | NUE | 34.02 | 13.60 | 2.48 | 1.51 | 2016-12-28 |

| PepsiCo | PEP | 45.03 | 11.30 | 2.92 | 3.01 | 2016-11-30 |

| Procter & Gamble | PG | 46.03 | 9.00 | 3.06 | 2.68 | 2017-01-18 |

| Phillip Morris | PM | 9.01 | 12.00 | 4.40 | 4.16 | 2016-12-20 |

| Pentair | PNR | 44.03 | 10.00 | 2.31 | 1.36 | 2016-10-19 |

| PPG Industries | PPG | 34.02 | 10.00 | 1.62 | 1.60 | 2016-11-08 |

| Sherwin-Williams | SHW | 32.02 | 14.80 | 1.18 | 3.36 | 2016-11-16 |

| Stanley Black & Decker Inc. | SWK | 32.02 | 9.60 | 1.93 | 2.32 | 2016-11-30 |

| Sysco | SYY | 44.03 | 15.30 | 2.45 | 1.32 | 2017-01-04 |

| AT&T | T | 33.02 | 10.00 | 4.73 | 1.96 | 2017-01-06 |

| Target Corporation | TGT | 34.02 | 11.00 | 3.74 | 2.40 | 2016-11-14 |

| T. Rowe Price | TROW | 29.02 | 15.00 | 2.93 | 2.16 | 2016-12-13 |

| VF Corporation | VFC | 32.02 | 10.30 | 3.24 | 1.68 | 2016-12-07 |

| Walgreens | WBA | 2.00 | 6.00 | 1.84 | 1.50 | 2016-11-15 |

| Walmart | WMT | 45.03 | 17.50 | 2.98 | 2.00 | 2016-12-07 |

| Exxon Mobil Corp | XOM | 46.03 | 10.00 | 3.49 | 3.00 | 2016-11-08 |

Benchmark: S&P 500 CAGR since 1/3/1970 is 7.02%. All but one stock in the above list have beaten the S&P 500 since 1970.

Thanks for stopping by and hope the post has been helpful.