Rate of return is the most important item to get really wealthy. There is so much focus on budgeting and spending less than you make in the personal finance industry. You do have to live on less than you make so you have something to save, but you don’t have to make yourself miserable. I firmly believe that the journey is very important. My wife and I don’t want to save everything to be rich later and not enjoy our lives now.

Rate of return is the most important item to get really wealthy. There is so much focus on budgeting and spending less than you make in the personal finance industry. You do have to live on less than you make so you have something to save, but you don’t have to make yourself miserable. I firmly believe that the journey is very important. My wife and I don’t want to save everything to be rich later and not enjoy our lives now.

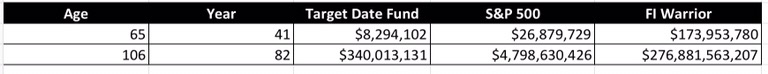

To illustrate the importance of rate of return, I built a spreadsheet that compares the growth of savings using 3 different rates of return, a Target Date Fund, the S&P 500, and my (FI Warrior’s) rate of return. I used the most recent 5 year for all three. I only have 5 years of data on myself and I wanted to be fair. I chose a Target Date Fund since most people have those in their 401k’s and they suck. Target Date funds routinely perform worse the the stock market average. The S&P 500 is the benchmark everyone gets measure against. A lot of people of those in their 401k’s too. An S&P 500 index is a decent option. I have the ability to do a “self directed” 401k. This means I can buy individual stocks or any mutual funds that Charles Schwab offers. Not many people have this option in their 401k, but if you do have it, get into it. Today. I was not able to get into it until early 2012 and you can see my portfolio take off in the graph at the top of the page.

For savings amount, I chose $1,200 per year. That is only $100 per month. You can change this yourself if you download a copy of the spreadsheet. I put in $18,000 a year since that is the IRS maximum for 401k’s in 2017.

I also run the numbers out 100 years because it is important for us to build and leave a legacy for our grandkids. The link to download your own copy of the spreadsheet is at the bottom of the table. You can tweak the gray cells with your own numbers if you don’t like the assumptions I use in this post.

Let’s highlight a couple points in time from the spreadsheet so you can really see the importance of the rate of return using a couple key points in time.

Save $1,200 a year from Age 25 to 65. For year 82, I used, grandkids are born at my age 60 and amount it is worth when the grandkids are 46 years old, my current age. A fun little what if scenario for me.

Save $18,000 a year from Age 25 to 65. For year 82, I used, grandkids are born at my age 60 and amount it is worth when the grandkids are 46 years old, my current age. A fun little what if scenario for me.

Rate of return on investments is extremely important, but does not get as much attention as it should. Most of the focus is around budgeting and deprivation to become wealthy. Spend a little time getting educated on investing to increase rate of return and enjoy the journey of life.

Thanks for stopping by and hope the post has been helpful.

Great tool, very telling as an adult, but more so for our children in terms of real potential… Nice work.

Thanks for the feedback Jason!