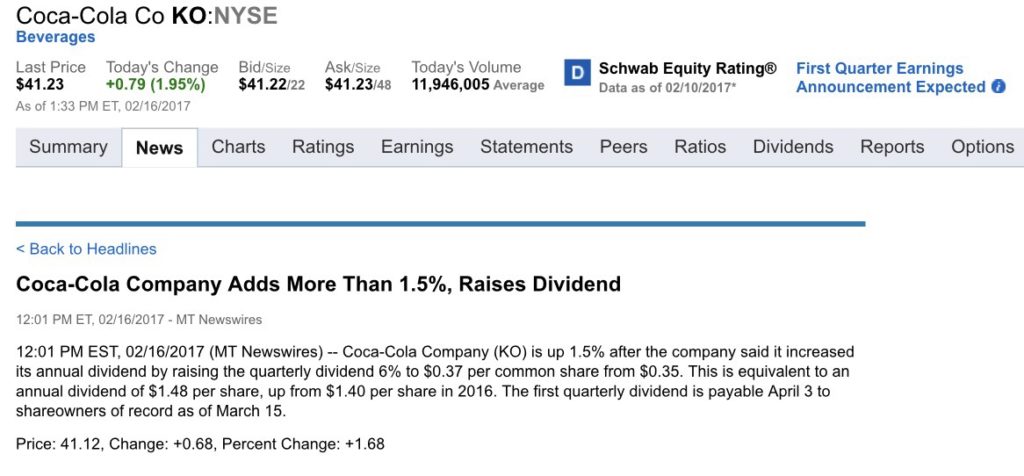

The main purpose of this post is to show you what a dividend increase looks like using a real wold example. The numbers for my position in Coca-Cola are not mind blowing, but can be if the number of shares are scaled up.

Coca-Cola raised their annual dividend 8 cents or 5.7%. The annual payout in 2016 was $1.40 per share. After the increase, the annual payout in 2017 was $1.48 per share. 8 cents per share might not sounds like a lot, but it can be depending on how many shares you have. I currently have 460 shares of KO.

Here’s what my numbers look like before and after the increase:

2016 – 460 x $1.40 = $644

2017 – 460 x $1.48 = $680.80

Using my portfolio, I will get $36.80 more of income after the increase. $36.80 is not going to change my family’s lifestyle, but over time with more dividend increases, buying more shares and dividend reinvestment, the amount of dividend income becomes more impressive.

The chart above shows KO’s dividend history since 2009. Let’s look at KO’ dividend increase history and run another example. For simplicity sake I will use the same 460 share number I used above.

2009 – 460 x $0.82 = $377.20

2017 – 460 x $1.48 = $680.80

In this example, I would be making $303.60 more than I did in 2009. Almost double the amount of income in 8 years. I don’t know too many people who are making double at their day jobs than what they were making in 2009. And you are in complete control of your dividend income.

If you want to run your own scenarios or dream a little, head over to this tool and put your own numbers in. For the scenario in this post, I would use $680.80 for the “Beginning Annual Dividends” and 5.7 for “Annual Dividend Percent Increase”. I always use 100 for “Number of Years” since I like to see what my grandkids will have.

I understand that dividends can get cut, but you dramatically reduce that risk by sticking with the Dividend Aristocrats. The Dividend Aristocrats also beat the S&P 500 index in rate of return as well. In English, the Dividend Aristocrats are paying you cash every quarter and grow faster (appreciate) than the S&P 500. It’s an awesome combination and I have seen it personally in my own portfolio.

Thanks for stopping by and hope the post has been helpful.