“What is this?” is exactly what I thought when I saw ABBV sitting as one of the top 3 CAGR’s when I was doing an analysis of the Dividend Aristocrats with my Crush the Market Tool. ABBV had a 19% CAGR over its lifetime and a 4.19% dividend yield at the time of my investigation. I already have a lot of Altria which is number 2.

AbbVie is in the biotech sector and a spin-off from Abbott Laboratories. Its most famous drug is Humira. Abbott Laboratories was the number 2 Dividend Aristocrat behind Altria (MO) in Jeremy Siegel’s book, The Future For Investors.

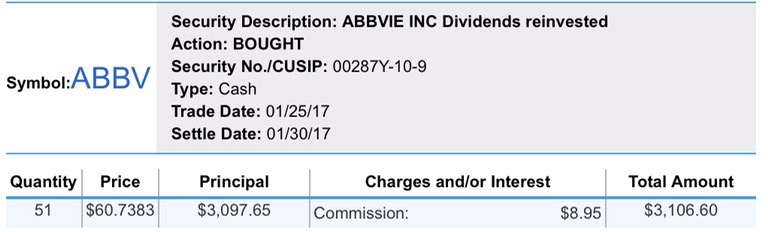

I bought some AbbVie (ABBV) stock on Wednesday. I had a buy stop limit order on it so if it kept going down, I could buy cheaper and if it went up 2% my order would trigger. It triggered.

Why did I buy AbbVie?

– It’s a Dividend Aristocrat

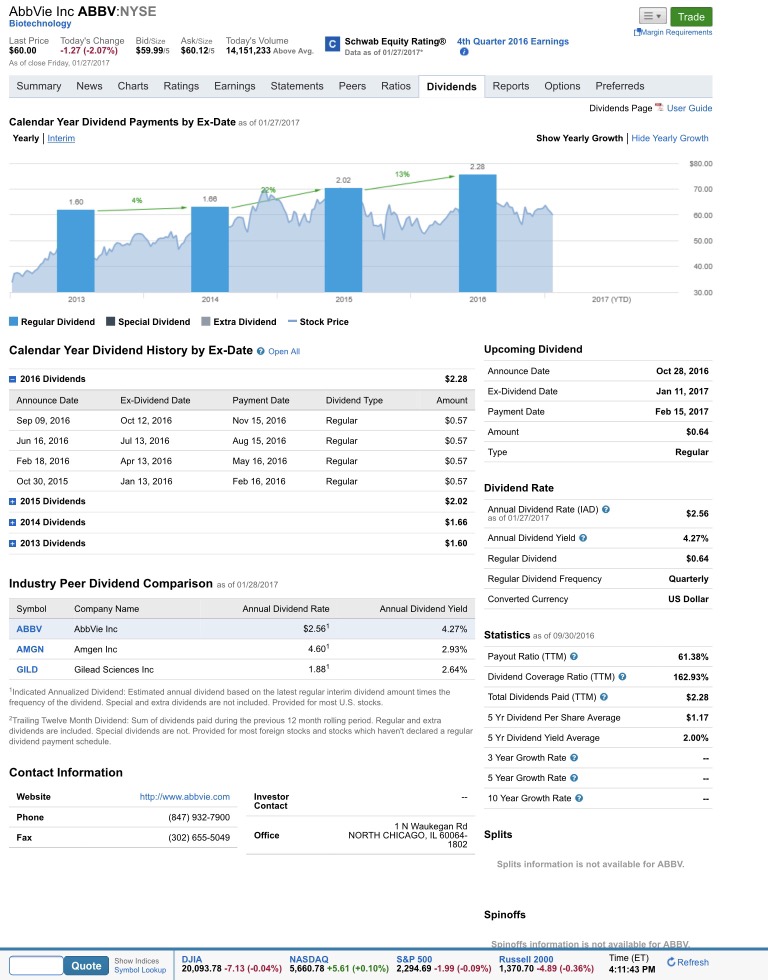

– ABBV’s current dividend yield of 4.27% is 2.27% higher than its 5 year average yield of 2.00%. A better way to look at it is (4.27-2.00)/2.o = 113.5% higher yield than 5 year average.

– ABBV just raised its dividend from $2.28 annually to $2.56 annually. That is a 12.28% increase. Here’s the math: (2.56-2.28)/2.28 = 12.28%.

The biggest reason I bought this stock:

The more than double the 5 year average dividend yield.

The 51 shares of ABBV will add $130.56 of annual dividend income for me. I might buy some more.

Below are the two charts I looked at when making the purchase decision. All the numbers I mention above are there. You can see in the “Growth of $10,ooo Investment” chart below that ABBV has outperformed the S&P 500 (Orange line) since ABBV was spun out of Abbott Labs.

Growth of $10,ooo Investment Chart:

Thanks for stopping by and hope the post has been helpful.