Today I am going to talk about the tool I mentioned last week in my January Portfolio update. I use it so I don’t lose too much money. The tool is the “Trailing Stop Sell” order. I have Trailing stop sell orders on all my stocks in all my accounts.

Protecting losses:

I put Trailing Stop Sell orders in place immediately after I buy a stock. So if a stock goes down immediately after I buy it, I will only lose the amount I chose to. I usually set mine between 5-10%.

Protecting Gains:

The nice thing about the Trailing Stop Sell orders is that it also protects gains as well. The same order I put in right after buying will still be in effect if a stock goes up past where I bought it. When the price of the stock moves up, the sell price moves up too. It adjusts automatically and by the minute when the stock market is open. Once the stock hits a new high, a new sell price gets set. The sell price will be based on that new high even it takes several days, weeks, months to go low enough to hit my 5% trailing stop sell order price.

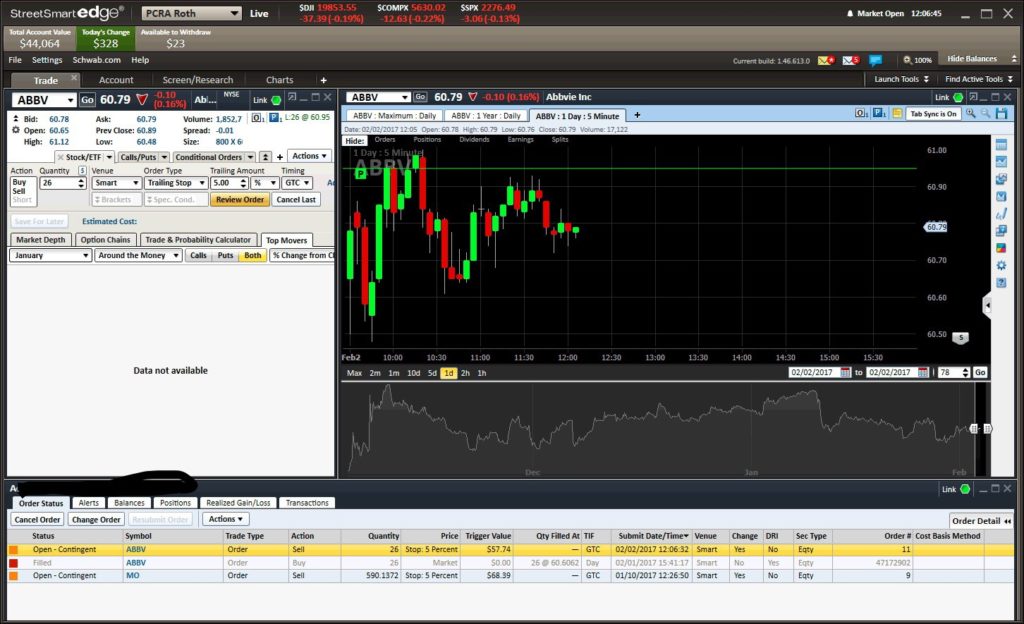

There is a lot on the screen above. Let’s look at the important part for setting up the order on the screenshot below.

Action: Sell. I set it to sell all the shares of ABBV in the account

Quantity: Number of shares you want to sell. You don’t have to sell all shares.

Venue: Smart. Unique name to Schwab.

Order Type: Trailing Stop

Trailing amount: This is the amount you are willing to let the stock pull back from its high. I chose 5%. % is in the next choice box. I could have also selected a $ amount.

Timing: GTC which means “Good Til Cancelled”. My trailing stop limit will stay in effect until I cancel it.

Click Review button to review the order. And OK on the next screen.

That’s it. I now have a Trailing Stop Sell in place in this account for 26 shares of ABBV.

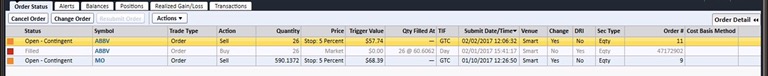

Here is what the screen looks like now.

Here is the important part of the screen.

The first order in the list is the Trailing Stop Sell I just created for ABBV. The Trigger Value column shows the price when I placed the order minus my 5% trailing stop or $57.74. ABBV was trading at $60.78 when I placed the order.

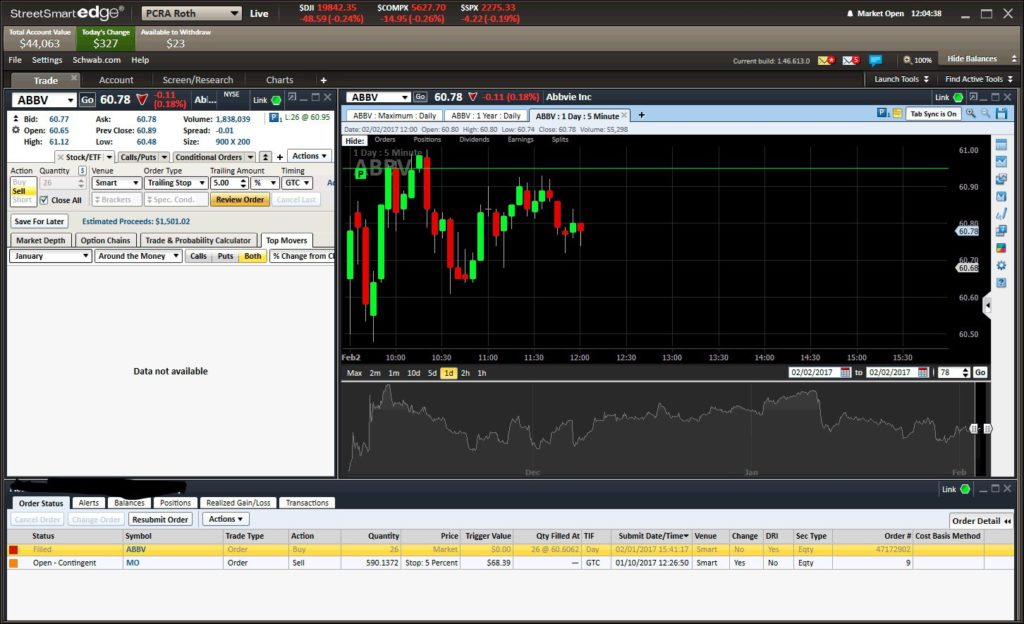

Here is what the same order looks like about a week later.

ABBV must have gone up a little since my Trigger Value moved up a little to $57.96. I did not have to do anything else, the Trigger Value just moved up since the stock moved up at some point.

Once in place, these orders are automatic and take the emotion out of the stock market. Like I mentioned in my other post, you can even be out of the country and completely disconnected and the order will execute.

I was here when one of my sell orders automatically executed. I did not know everything sold off until I got back in the US and had cellular coverage. Pretty awesome.

Thanks for stopping by and hope the post has been helpful.

Sorry Steve I am just catching up on the posts. Its been one of those weeks.

I get the limitation on exposure especially to the downside and I have some accounts set up similarly through funds that cap the loss and the gain. When you set this up individually with stocks do you convert it to cash on the sell? Do you have to pay tax on this or do you sweep it to another account? Just curious. The biggest head wind I see to some of my investments are the tax implications and I am trying to limit my exposure to tax hits based on my short and long term gains.

Jon, No problem, I understand. Having one of those weeks myself. Yes, when mine sell off, it converts to cash. On the non-tax sheltered account, I do pay taxes in the year it sells off. I feel the same you do on limiting taxes, but protecting gains (making money) and paying tax as I go is better than losing the money. For me. On my tax sheltered accounts (401k, Roth, and IRA), I do not pay taxes now when they sell off. I’ll pay taxes on the accounts (except Roth) when I start taking money out when I retire. Nothing you can really do there. I’ve mentally adjusted my self to paying taxes on the gains by thinking of it as regular income. I would not tell my boss not to give me a raise so I don’t have to pay taxes. I’ll take the increase in salary and pay taxes. 🙂