Dividend: A dividend is a payment made by a corporation to its shareholders, usually as a distribution of profits, straight from Wikipedia.

Let me show you what a quarterly dividend payment looks like with real numbers from one of my stocks.

MO (Altria) is paying $2.44 annually per share owned. That works out to be $0.61 every 3 months or quarter.

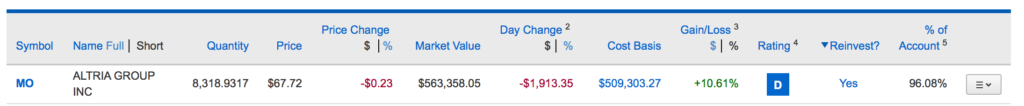

Here is what it looks like as it goes into my account. It’s pretty simple and straight forward math, but I confused about it before I got educated. I wanted to demystify that process for you and show you with real numbers in a real account.

Shares owned x quarterly dividend = cash deposit

8,318.9317 x $0.61 = $5,074.55

Monthly income is $5,074.55 / 3 = $1,691.52. I like to look at the payments in monthly terms since that is how I think about my regular salaried income.

Dividend Reinvestment Share Purchase![]()

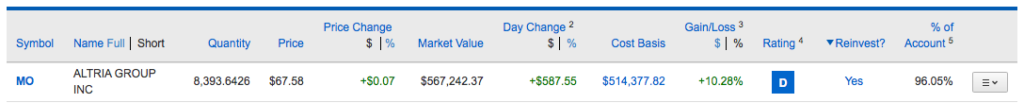

Number of Shares In Account After Dividend Reinvestment

Next quarter dividends will be 8,393.6426 x $0.61 = $5,120.12. And that’s just from reinvesting the dividends. For the last 47 years, the big changes comes at the end of August every year and I’ll show you that when we get there this year.

Since I’m after income, dividends are what really matter, not the stock price itself.

Slow and steady. Patience. Time. Consistency.

Every time I read the book, the tortoise wins.

Thanks for stopping by and I hope the post helps.

This was a very clear breakdown. Great post!

Thanks Alex!

Awesome! Thanks for using real life numbers!

Thanks Jason. I’m glad it helped.